Revised GST rates

The GST Council on Friday overhauled the indirect tax regime reducing the 28 percent tax levied on 178 items to 18 percent or lesser.

The GST Council on Friday overhauled the new tax regime reducing the 28 percent tax levied on 178 items to 18 percent or lesser. Most important of them all, the Council decided to salsh the tax rate on AC and non-AC restaurants to 5 percent from the current 18 percent slab. The new rates will be applicable effective November 15.

The council, which met Guwahati, has decided to cut keep only 50 luxury and ‘sin’ goods like tobacco in the highest slab, paving the way for price cuts in a raft of commonly used goods from furniture to sanitary ware. The move, which is likely to cost the exchequer Rs 20,000 crore, comes on the back of trader protests and the upcoming Gujarat Assembly elections.

“We have rationalised certain items from the 28% to the 18% or even less. Optically, there are few items that shouldn’t be at 28% that were there earlier. There were 228 items in the 28% slab, 178 out of which have been shifted out of the slab. Cess items such as luxury items, sin goods, white goods, auto parts, cement, paint among others are the only ones remain in 28% category,” Finance Minister Arun Jaitley said, addressing the media after the GST Council meeting.

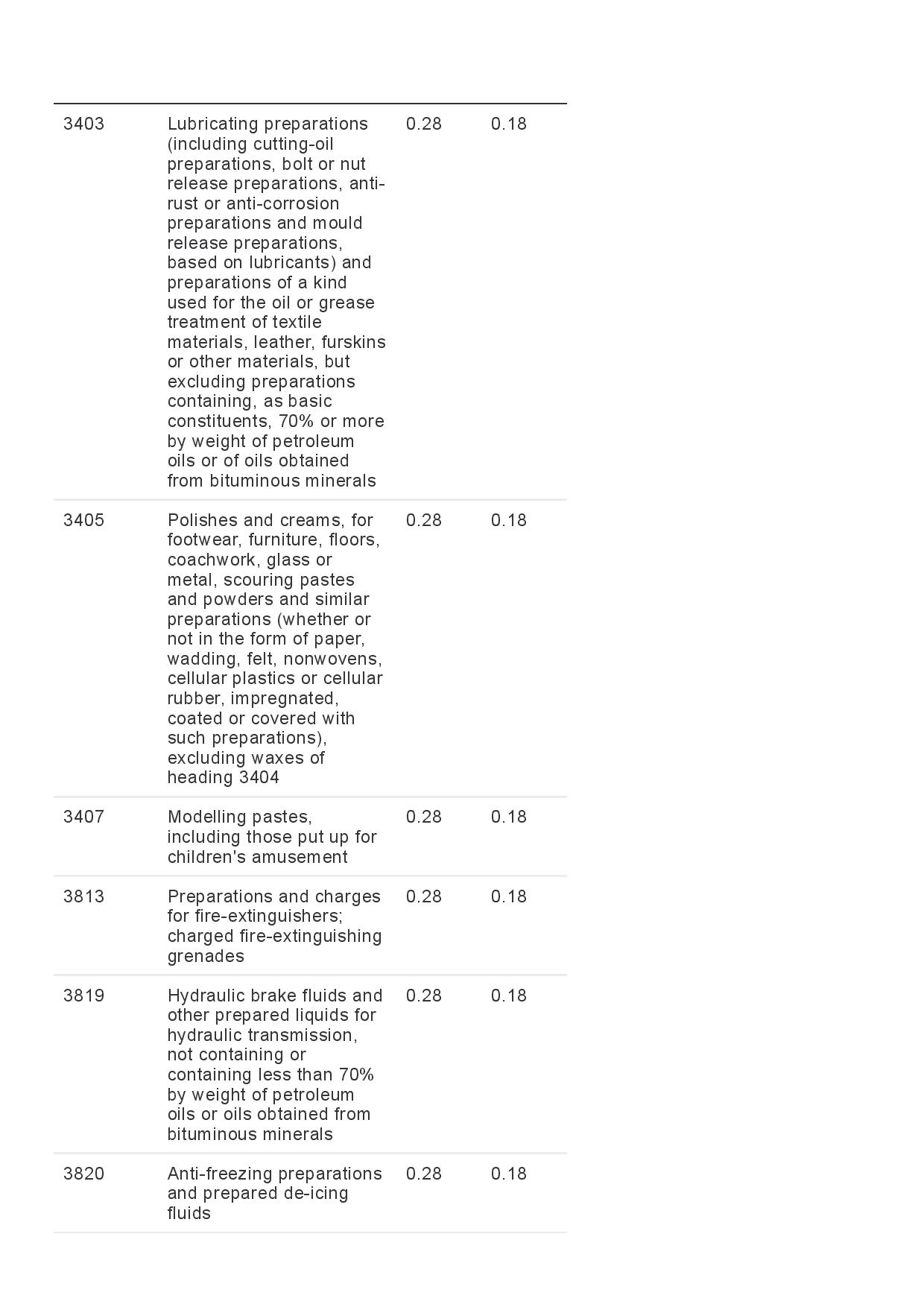

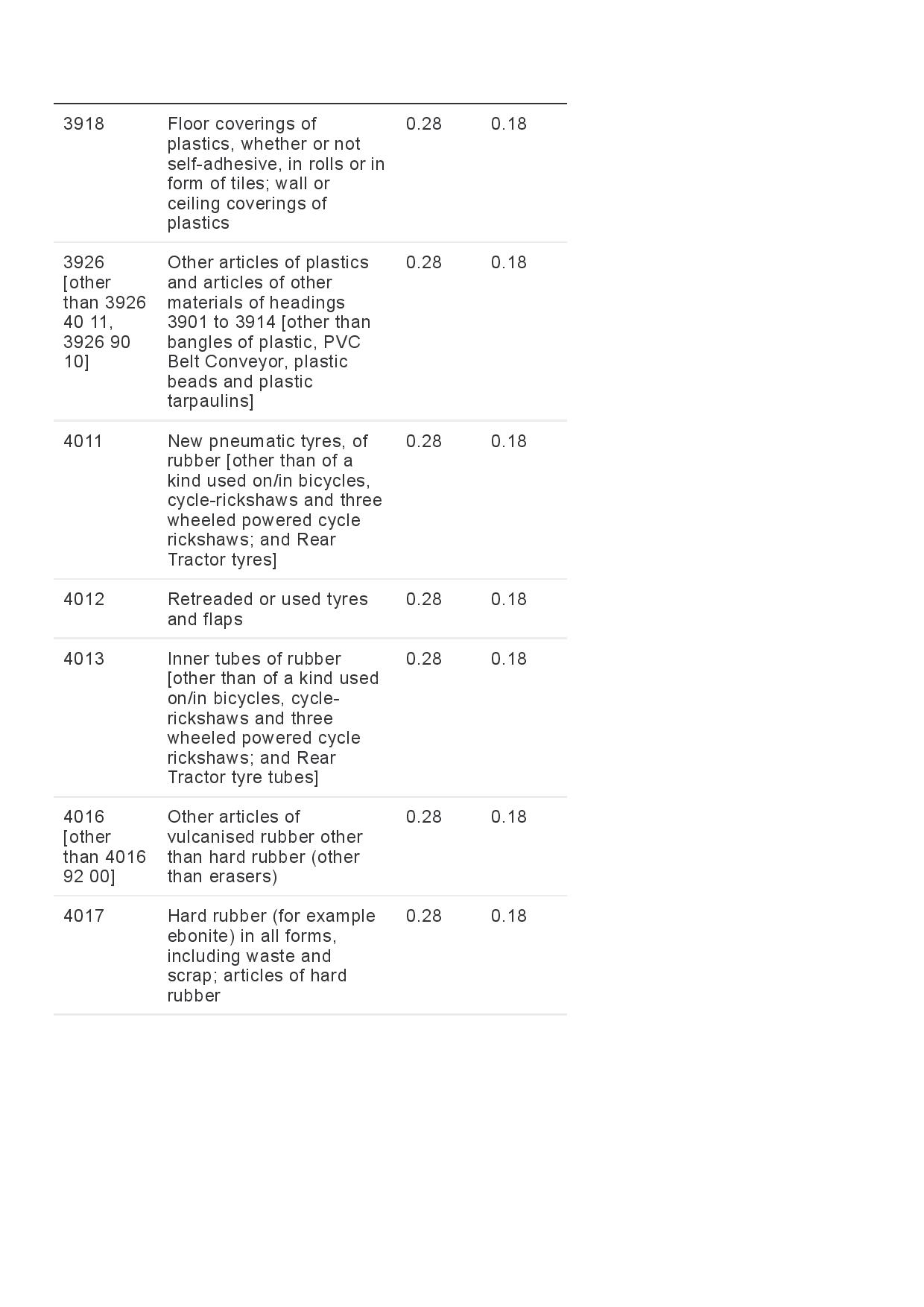

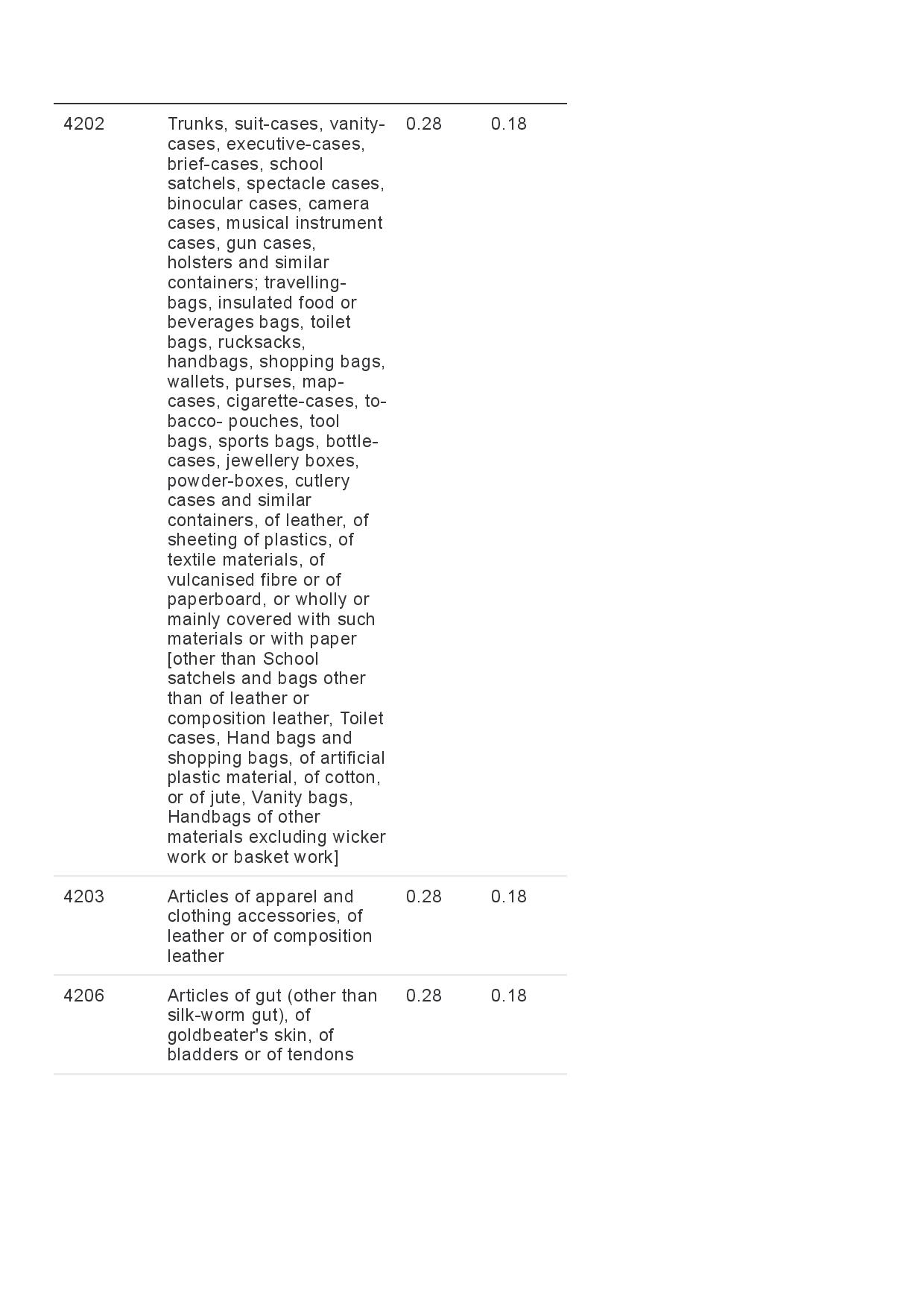

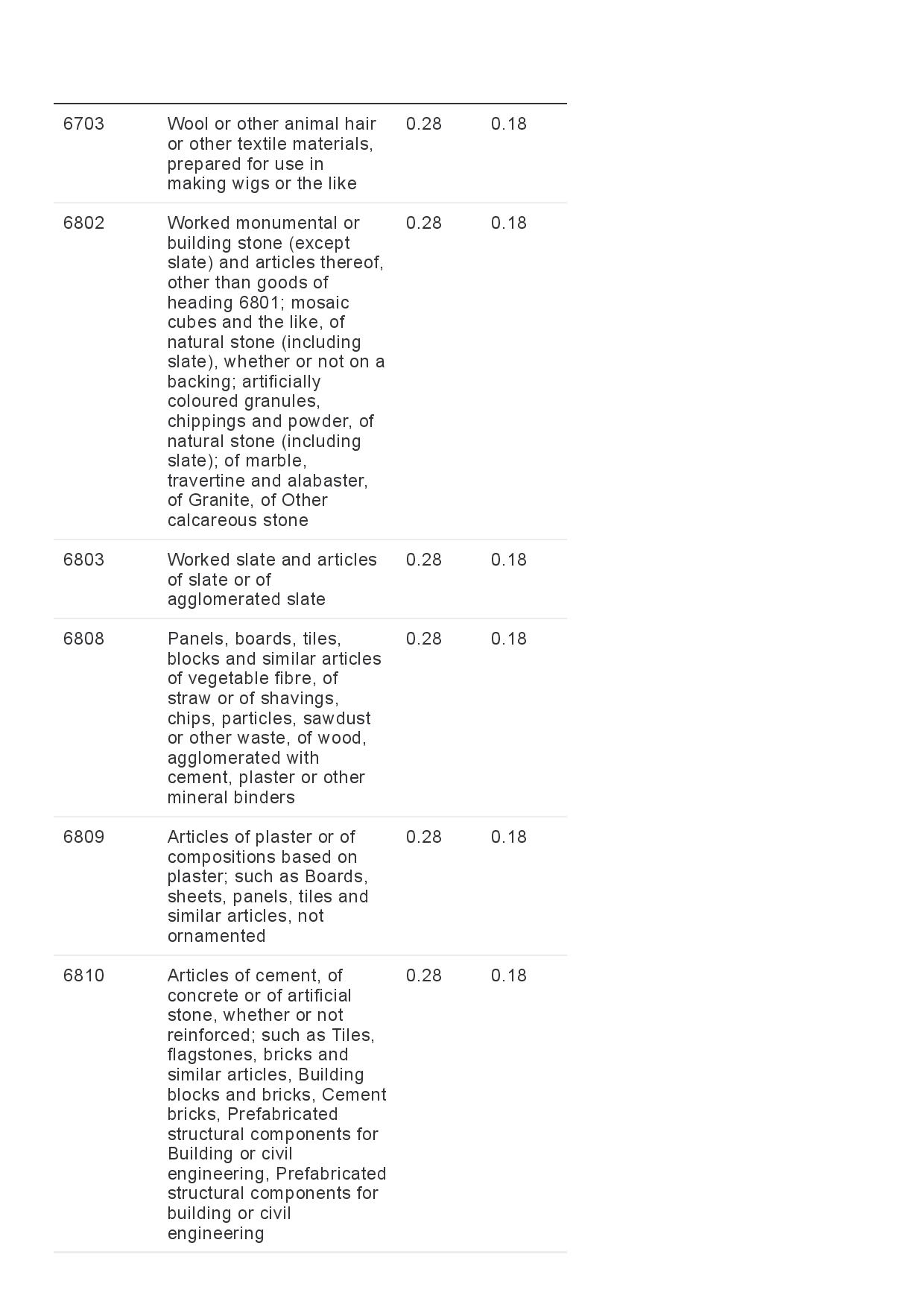

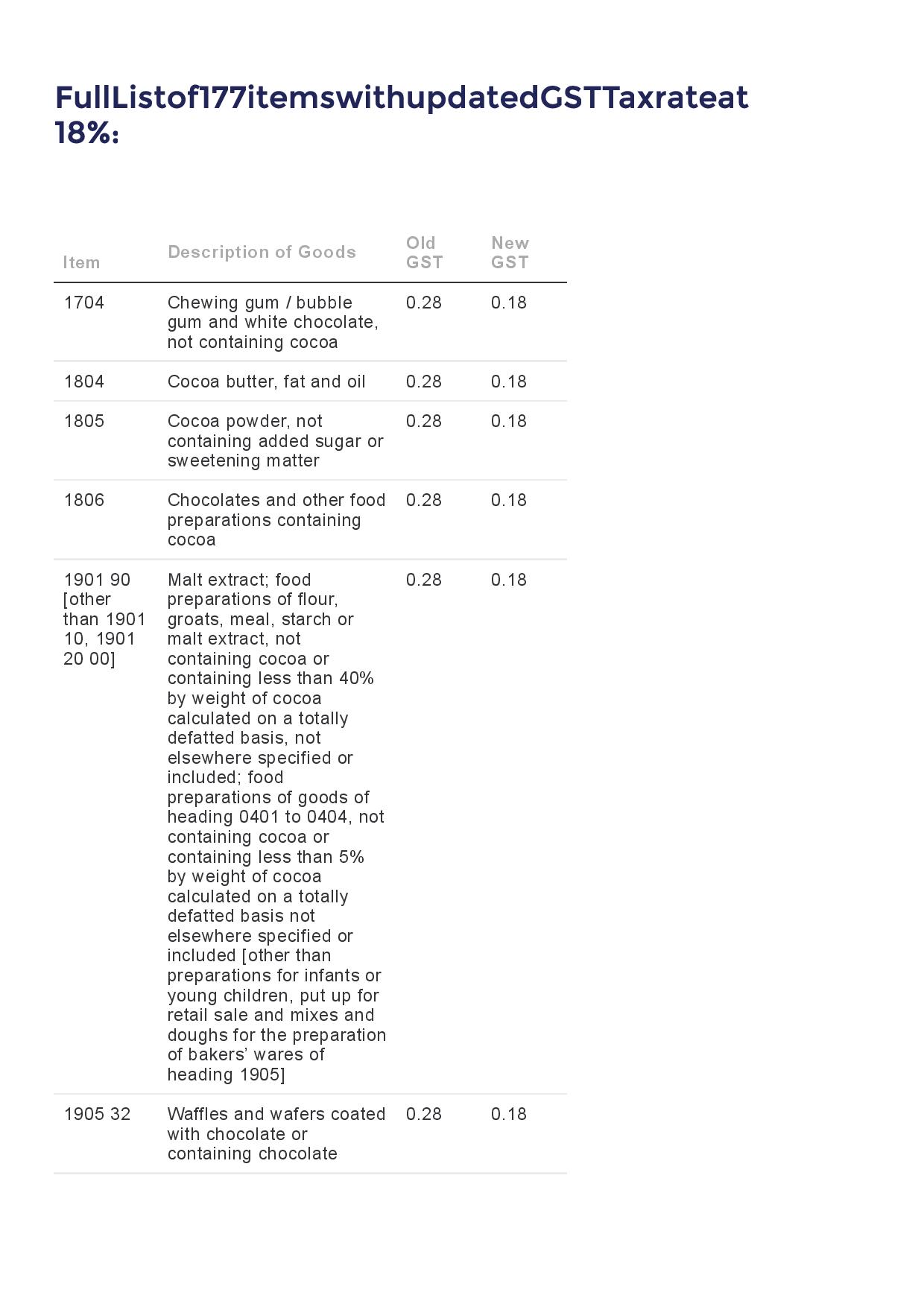

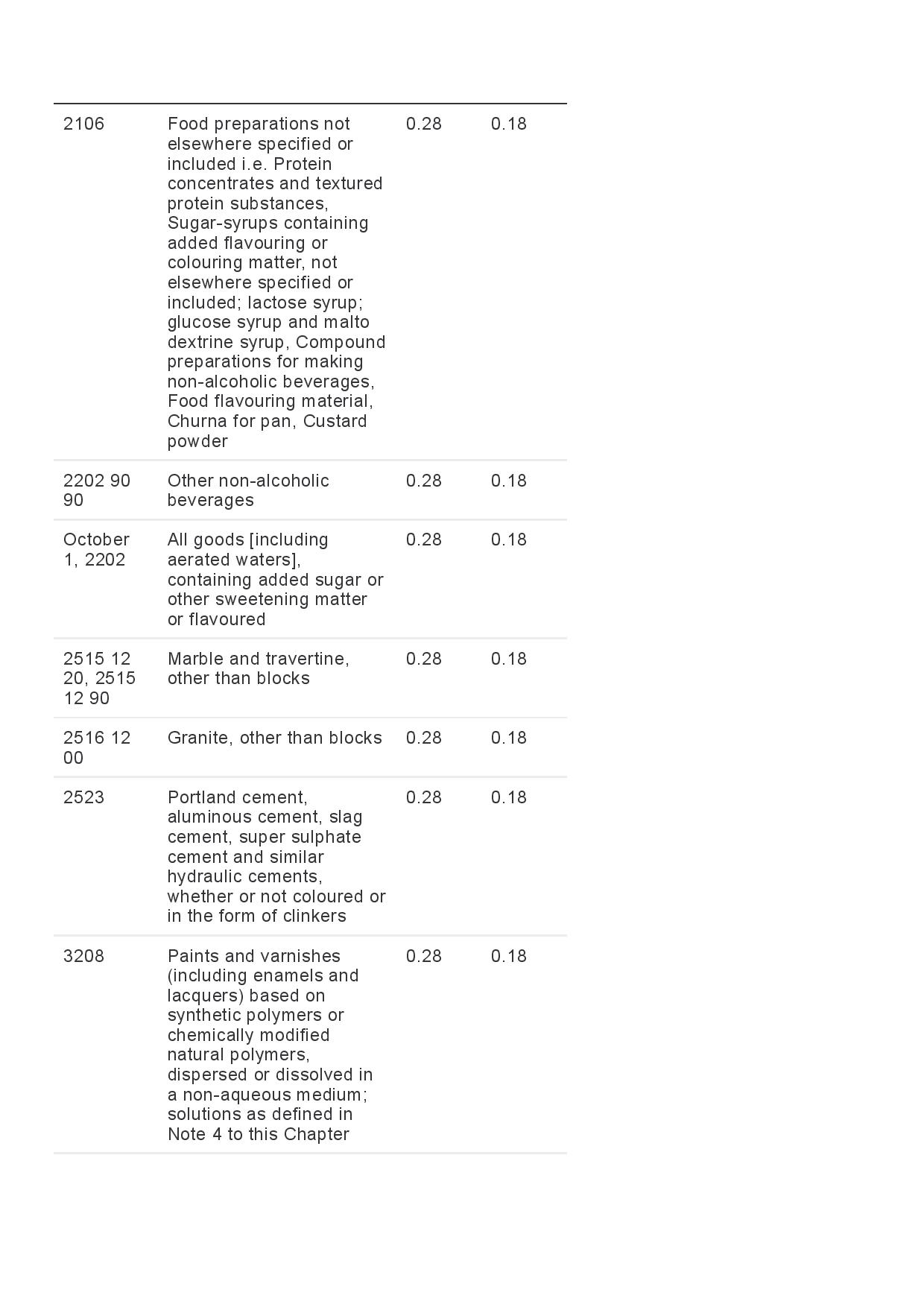

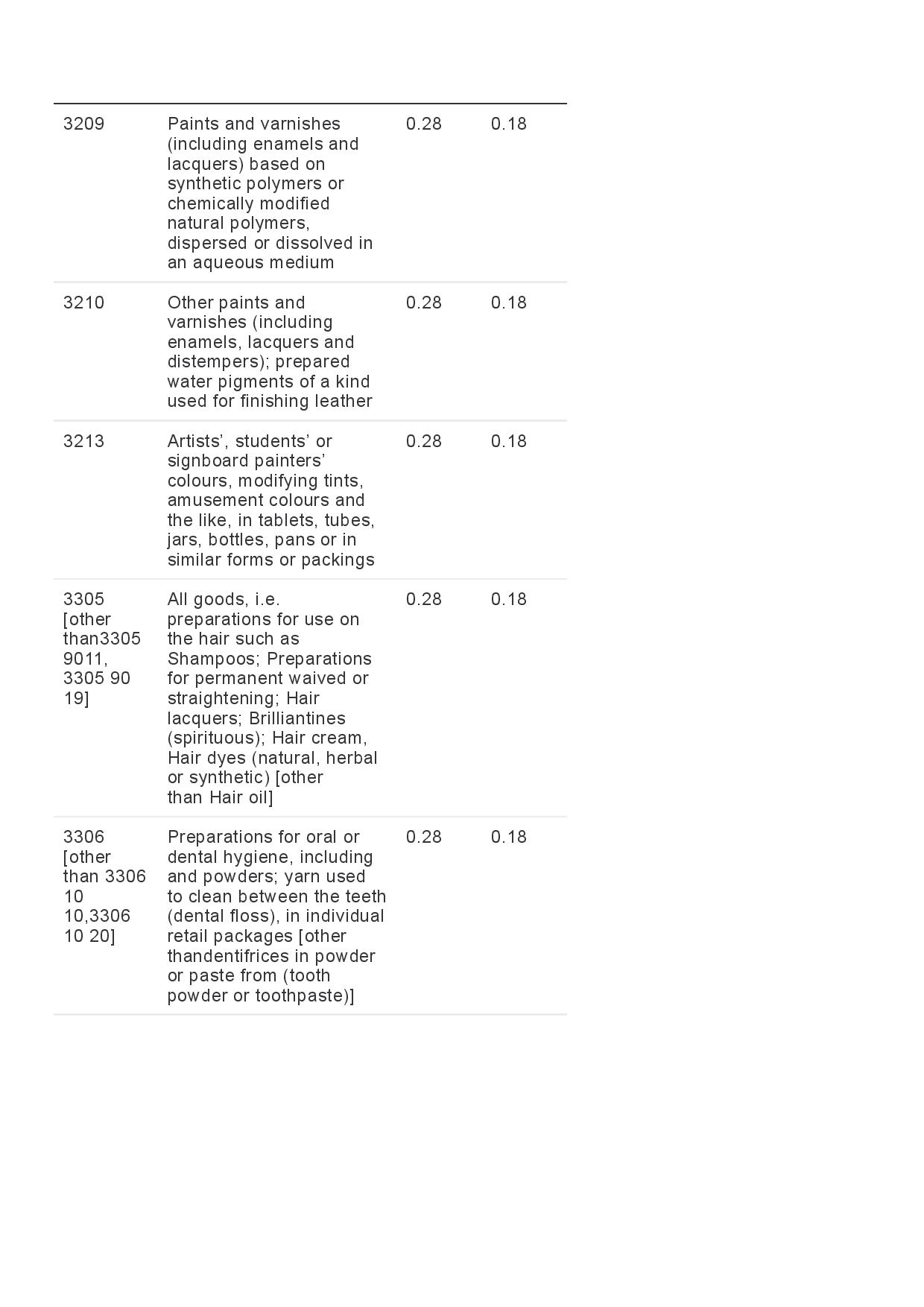

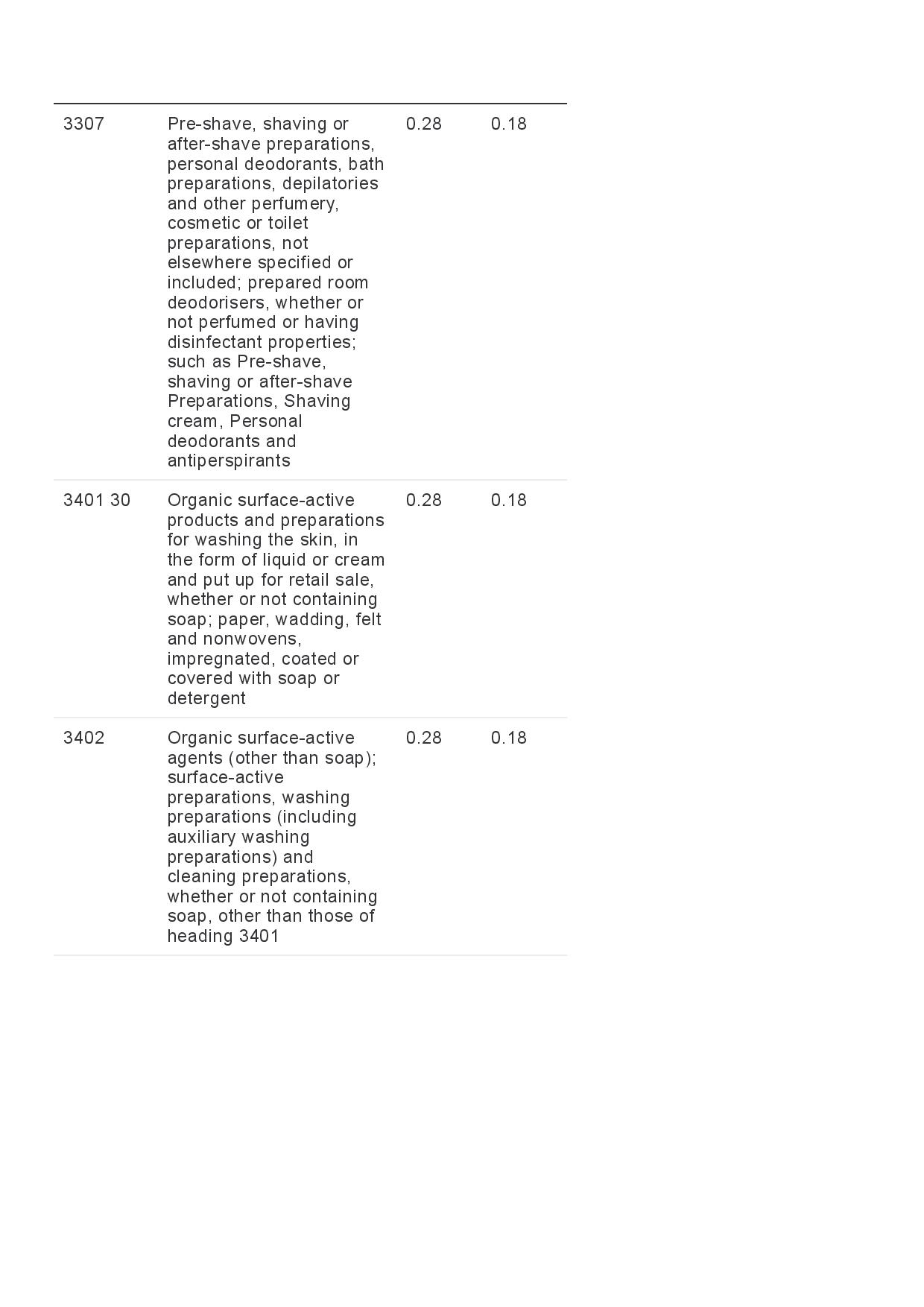

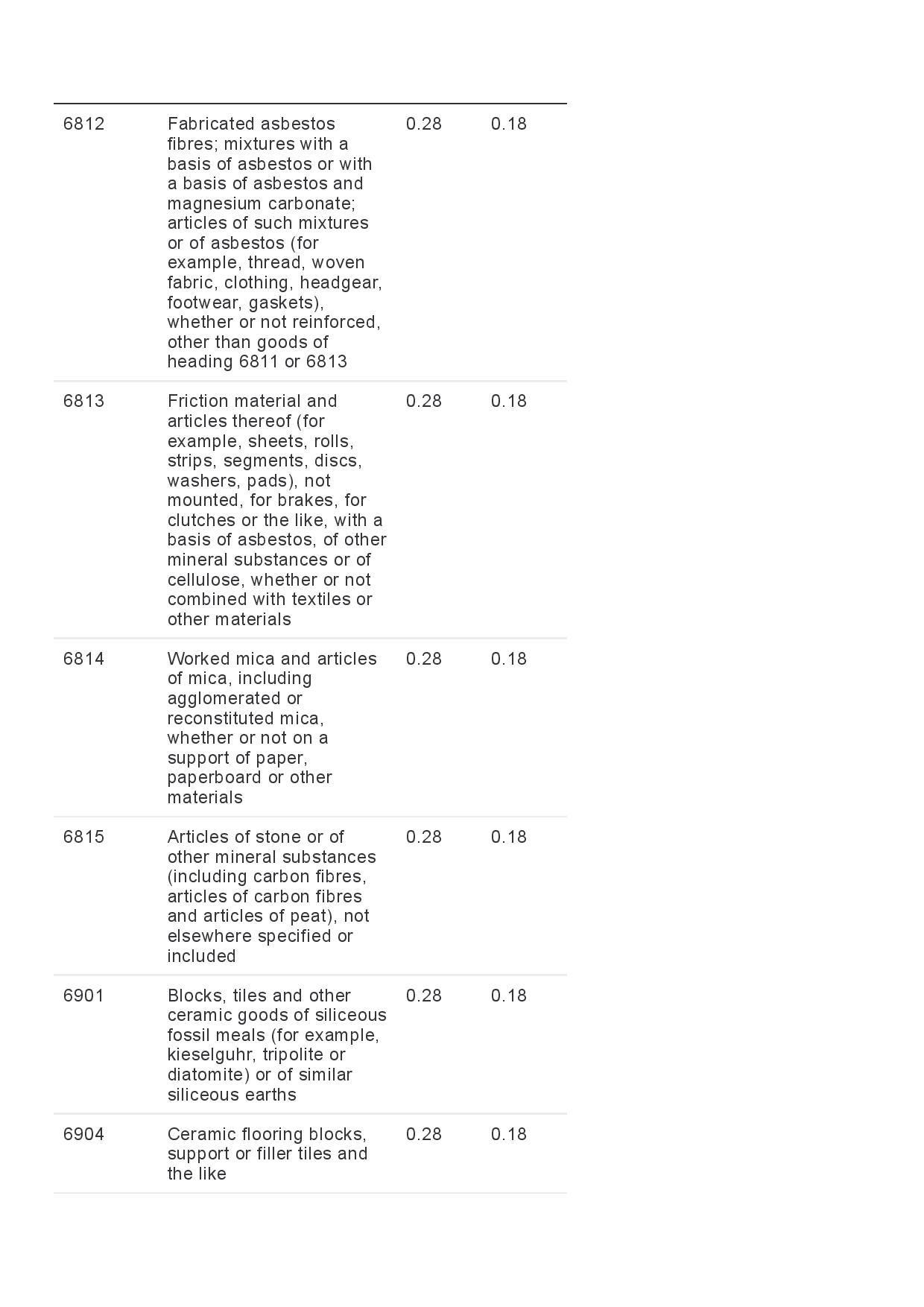

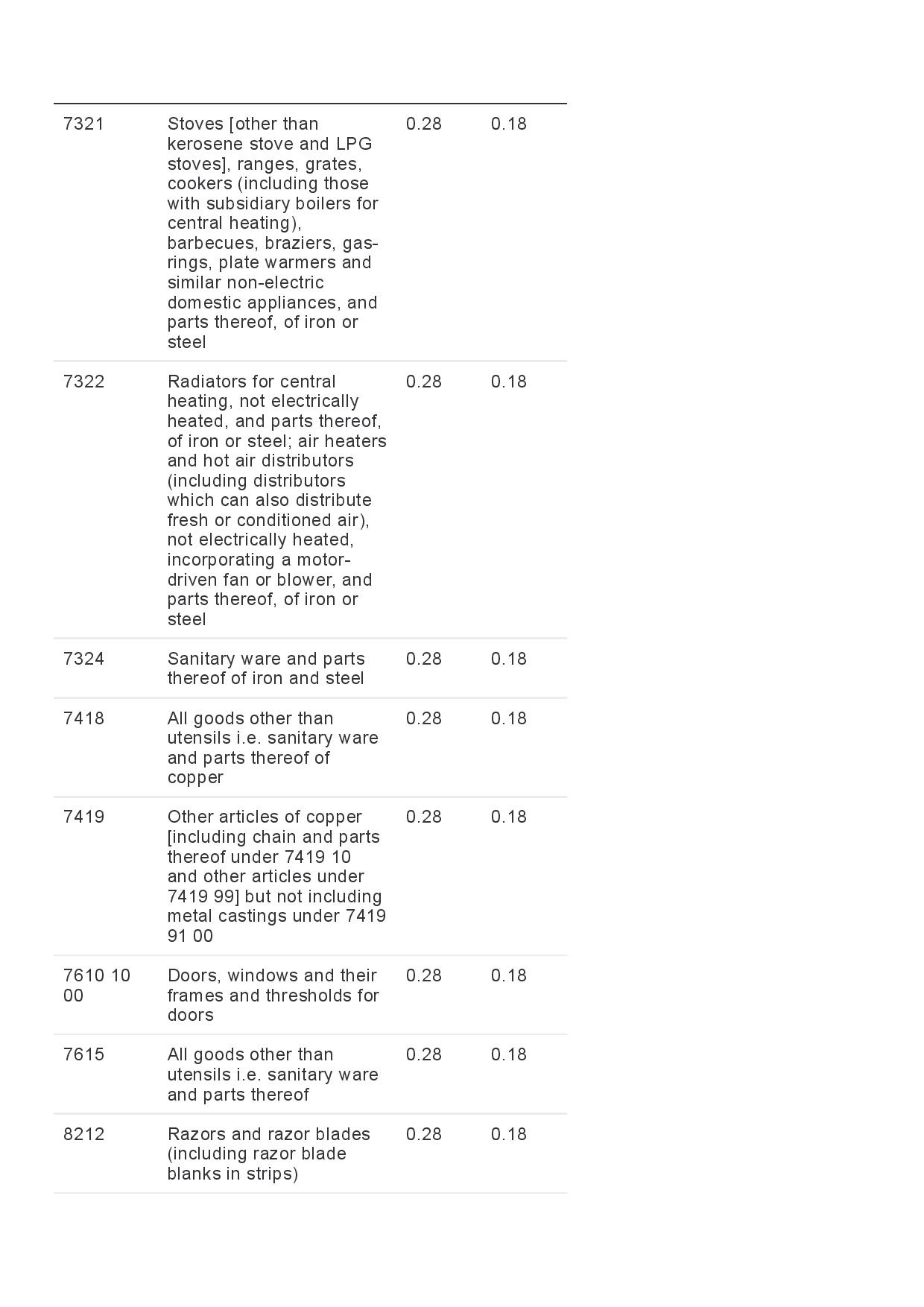

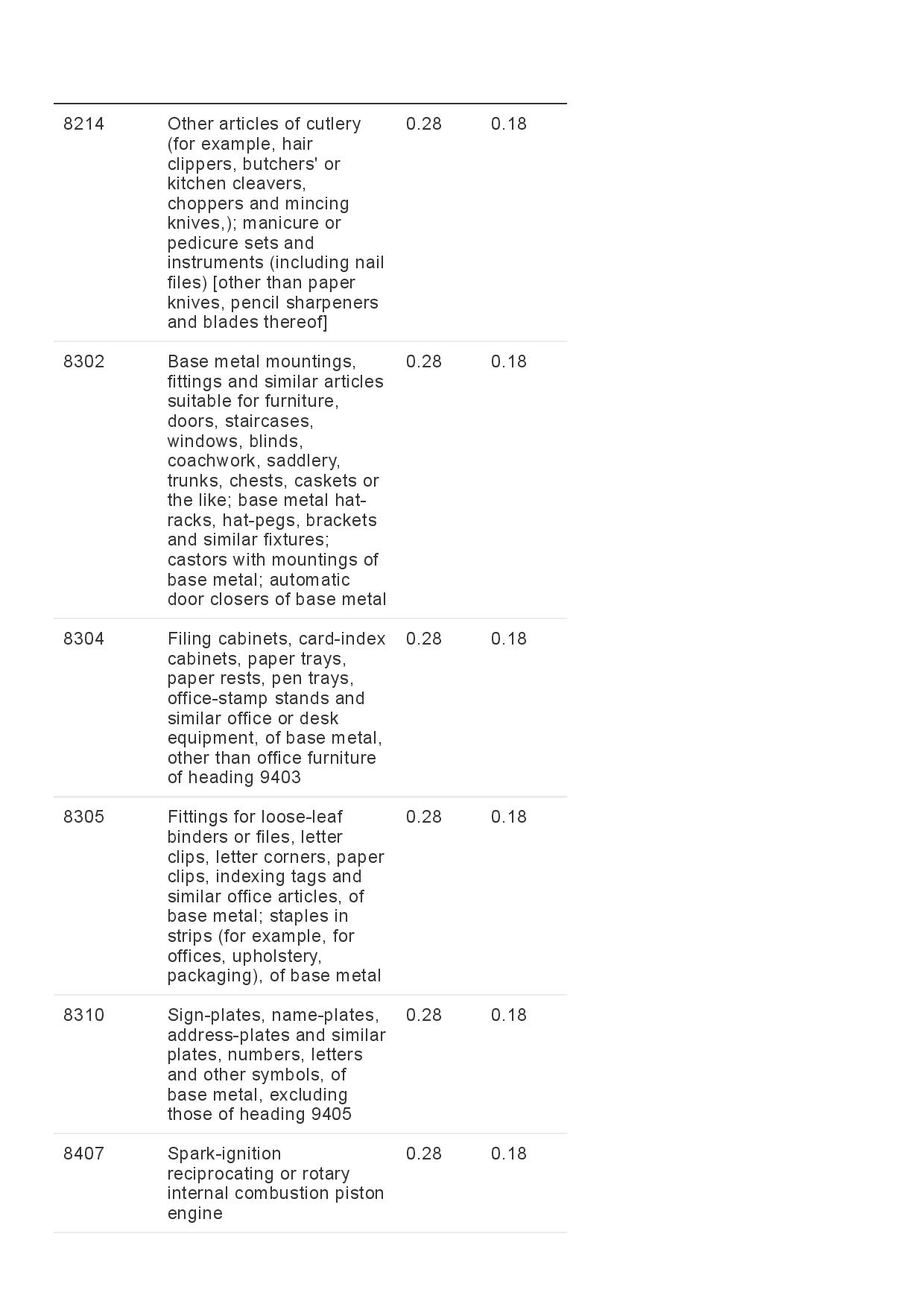

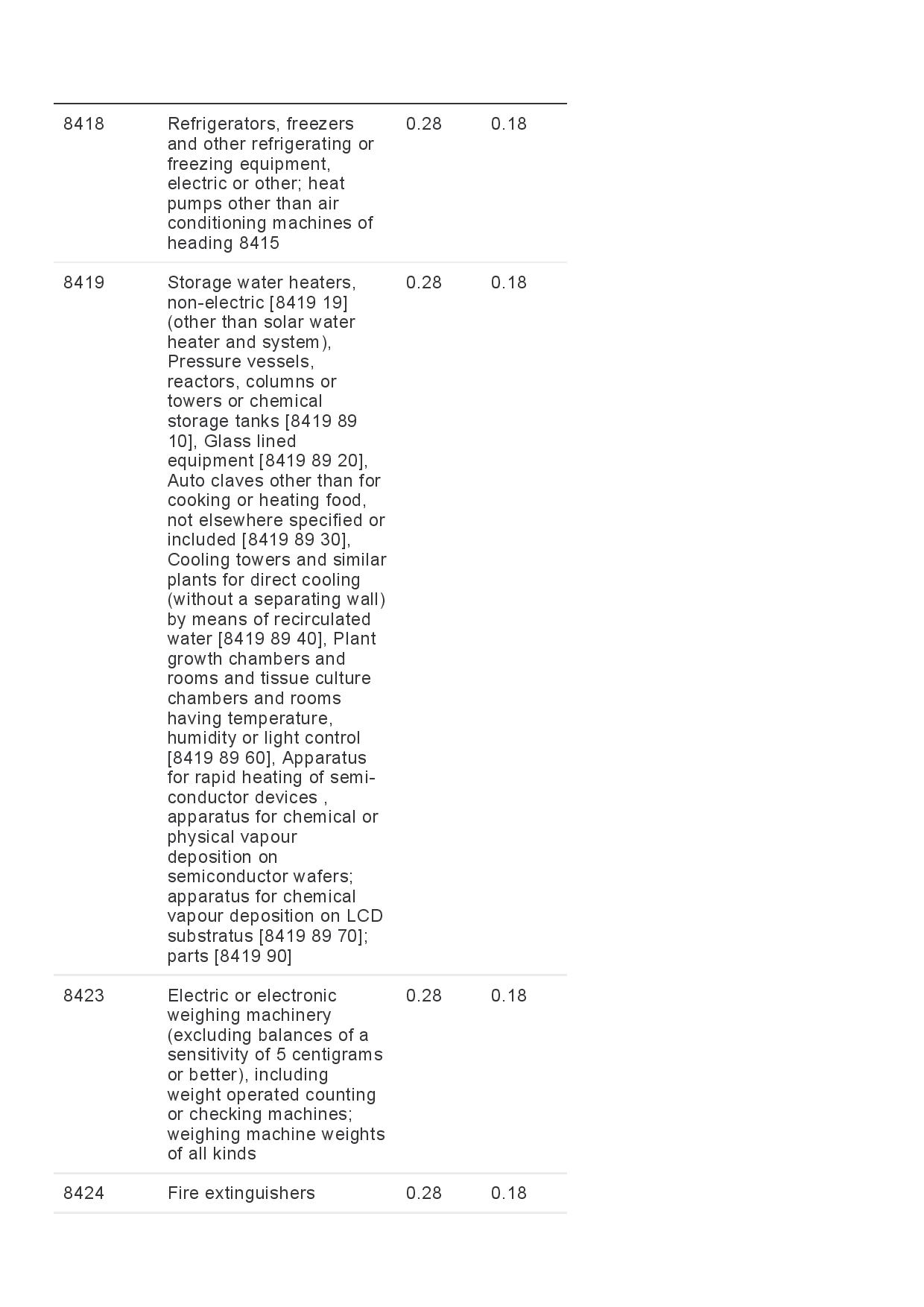

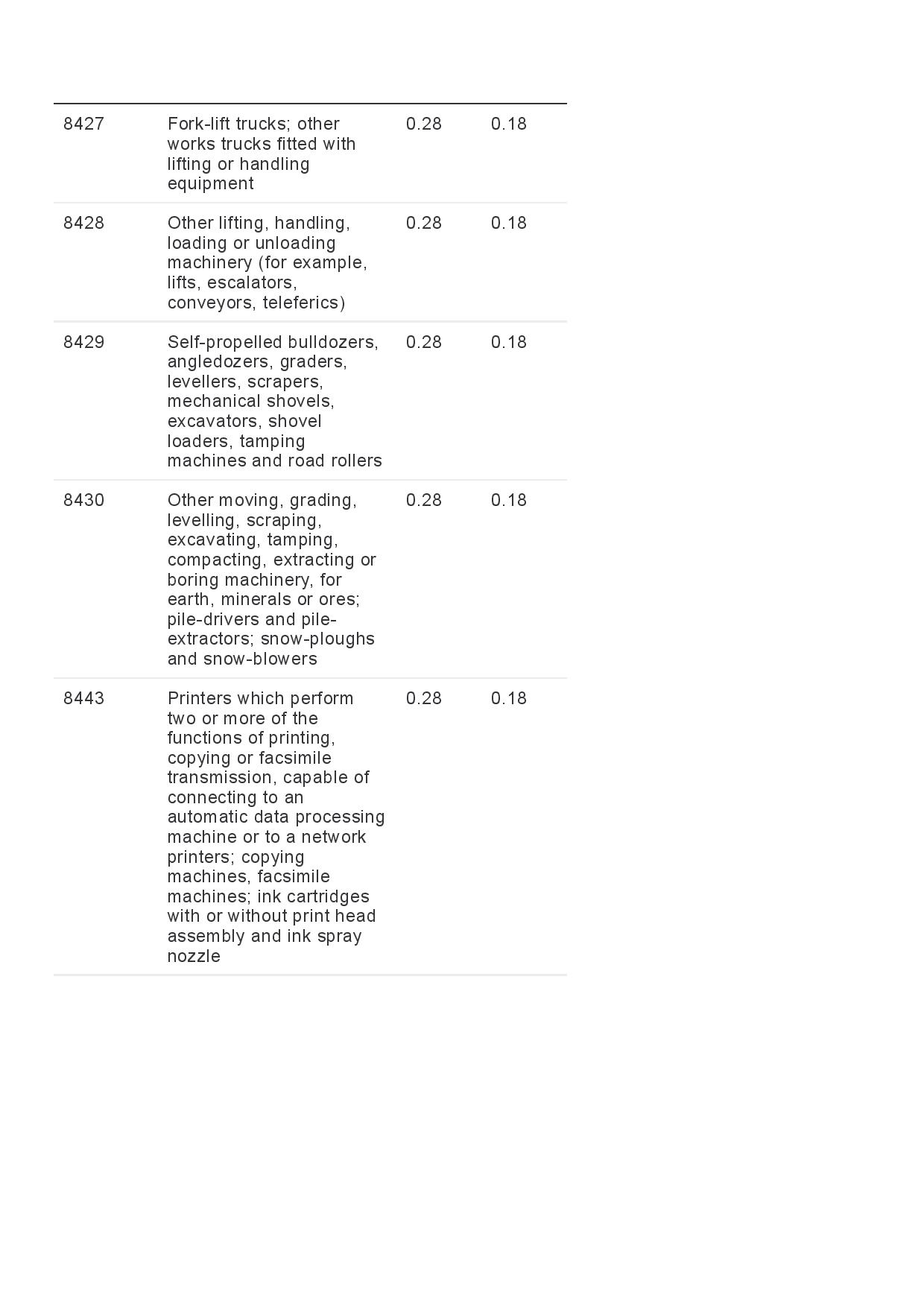

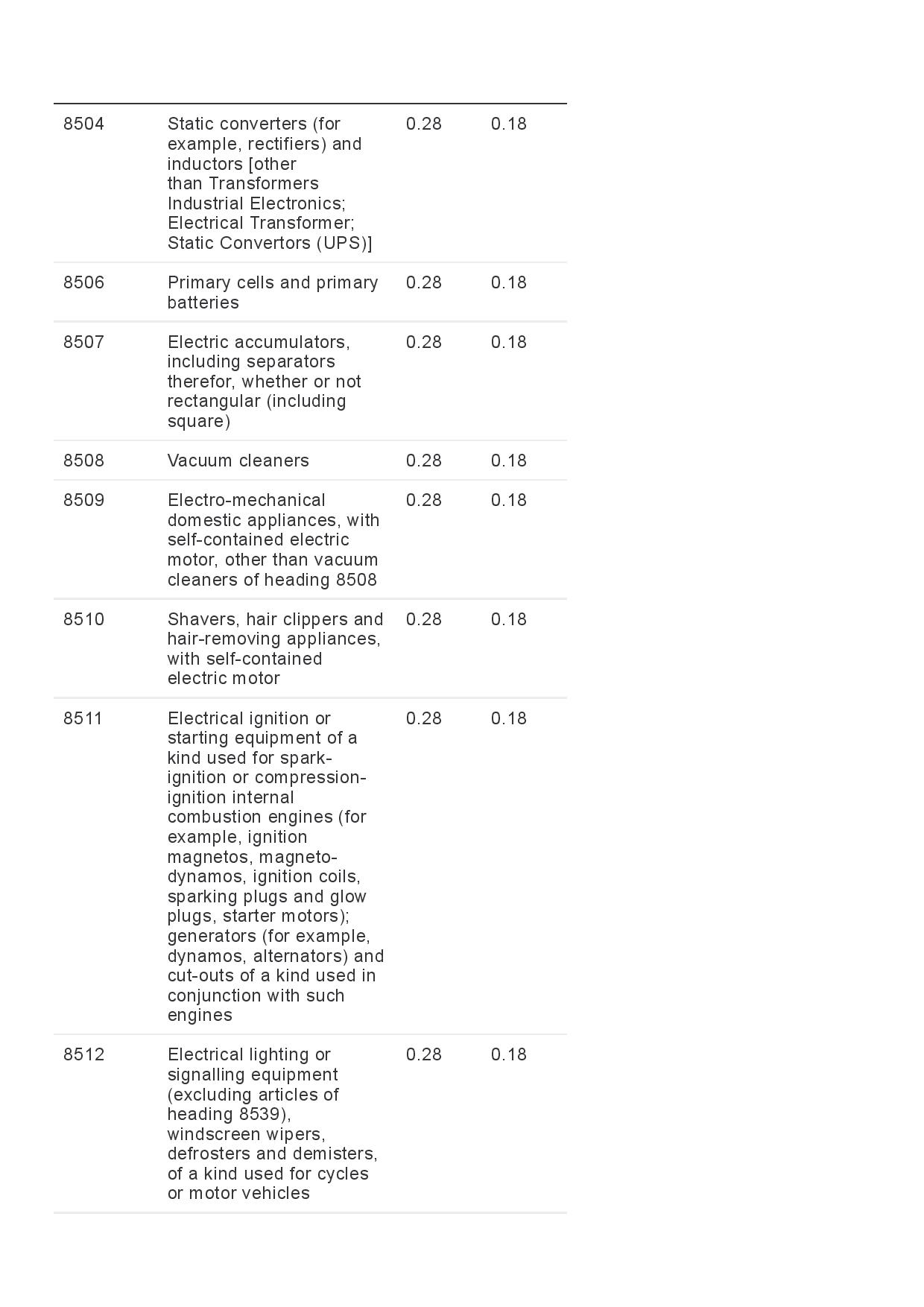

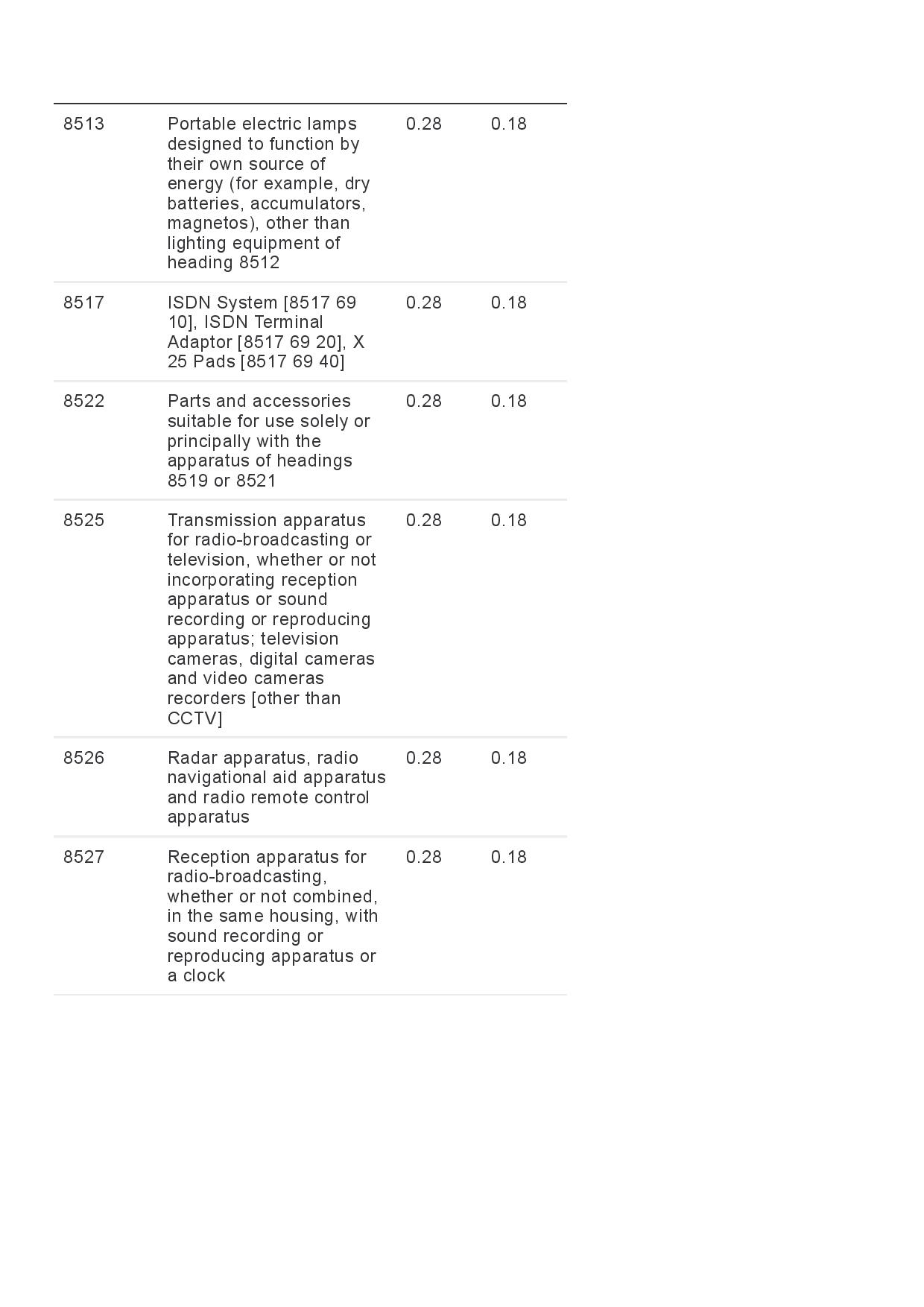

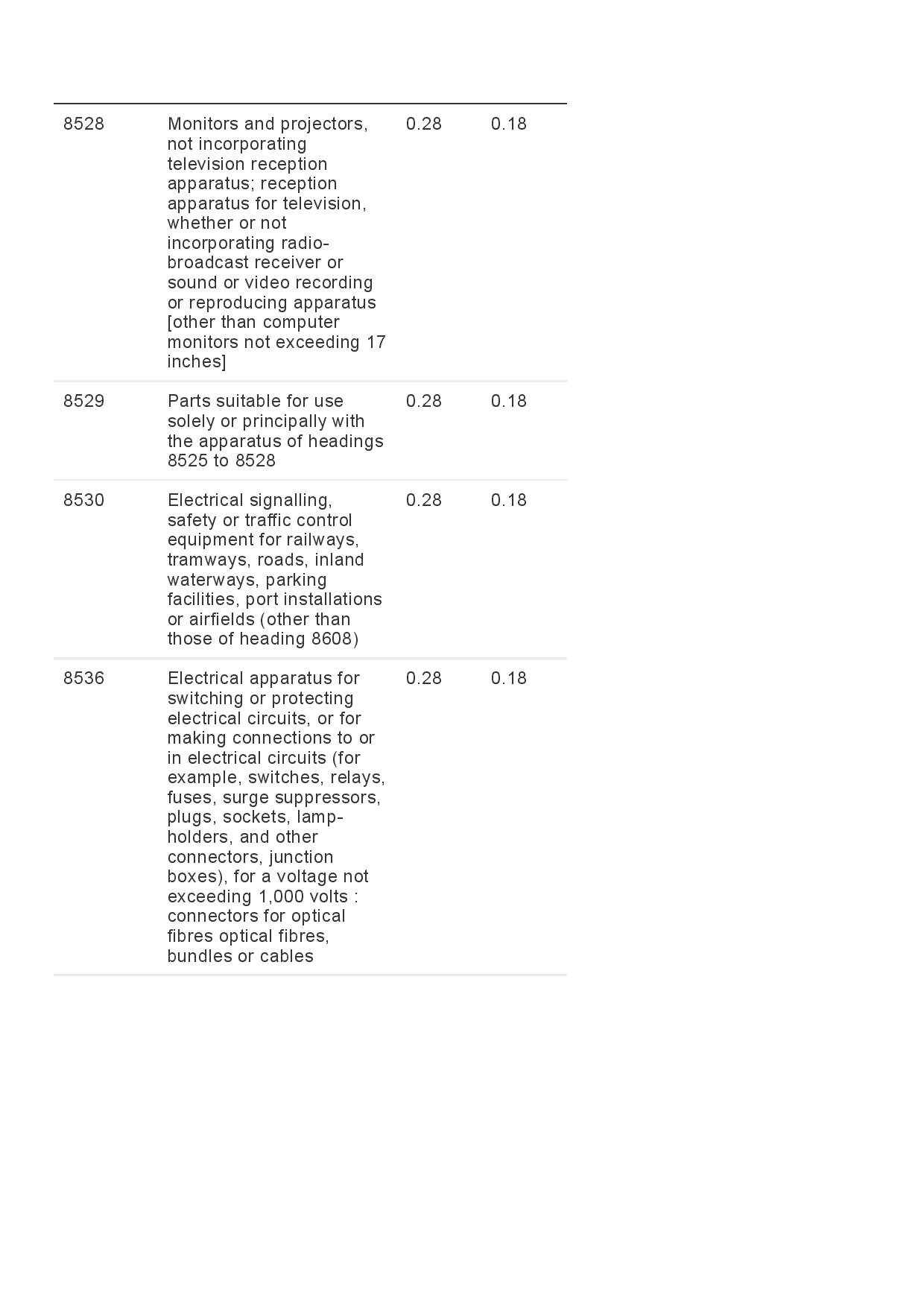

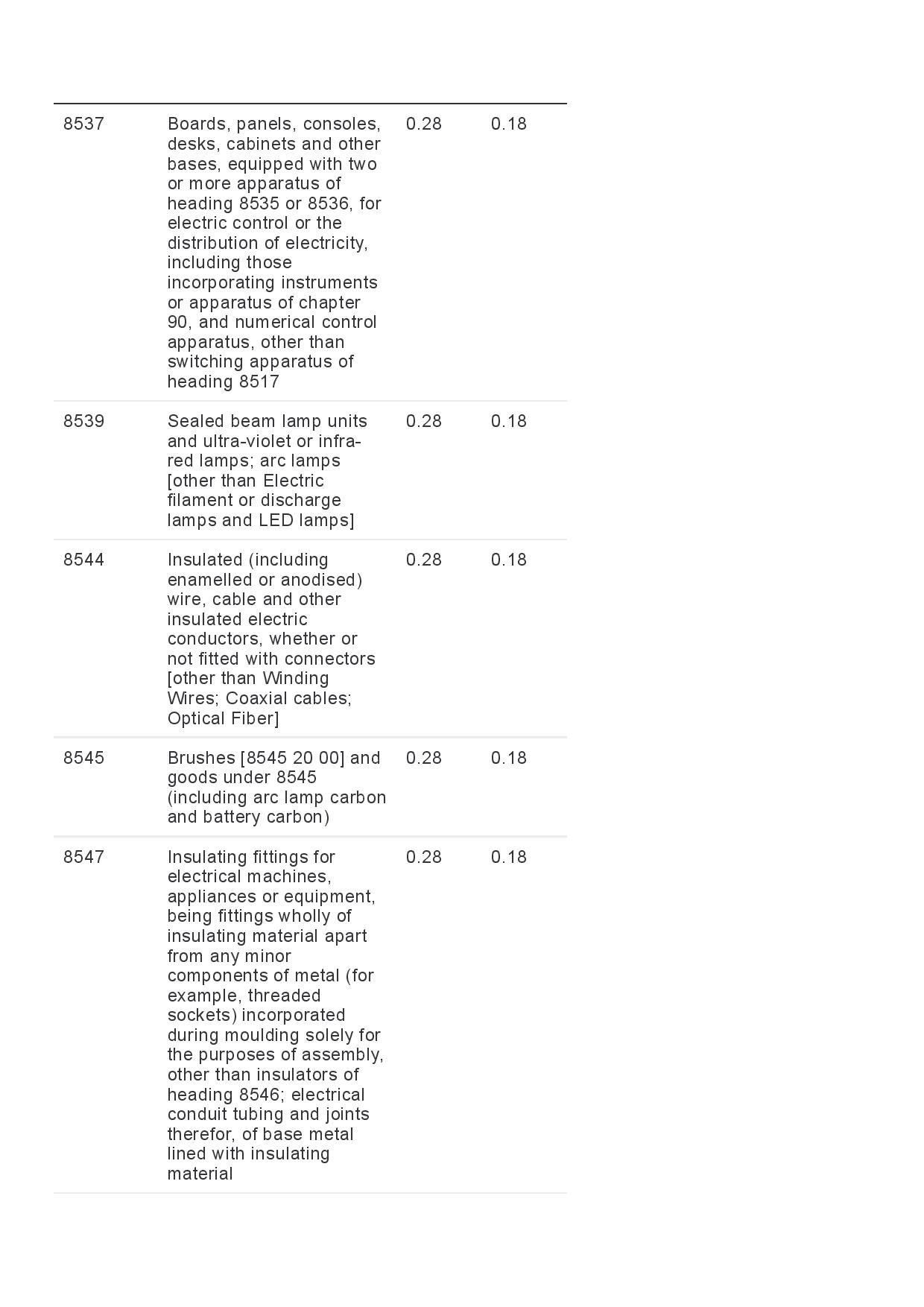

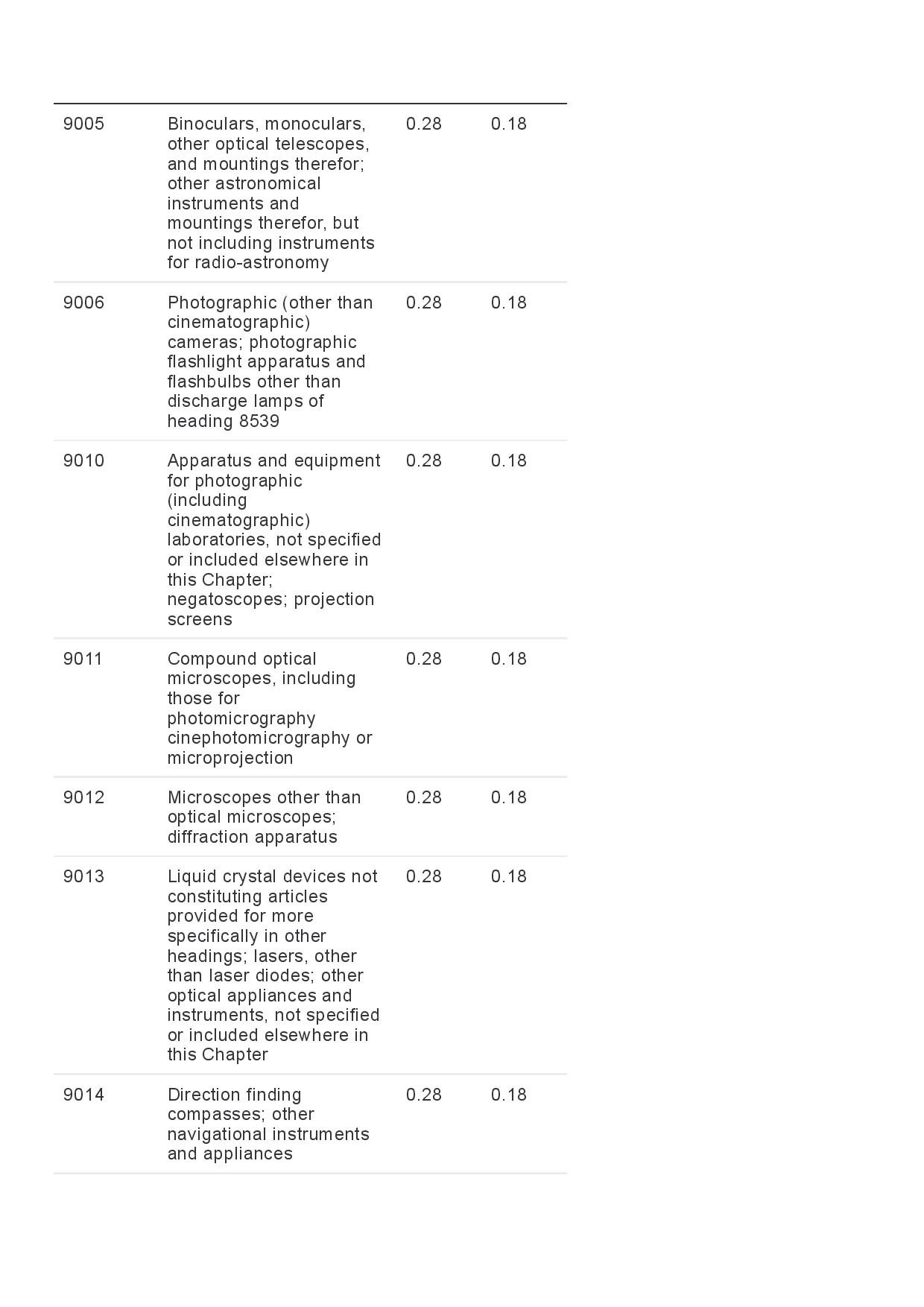

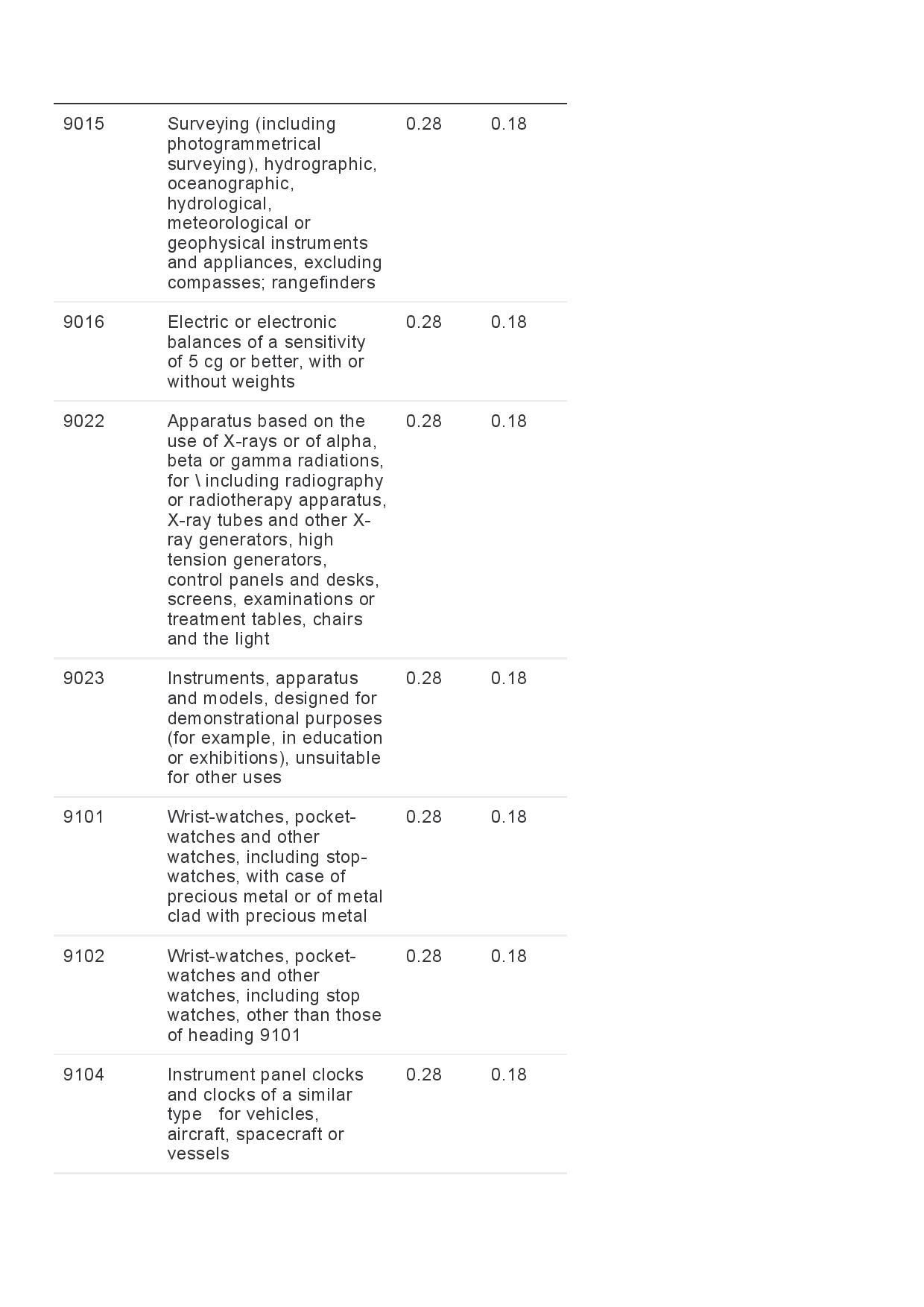

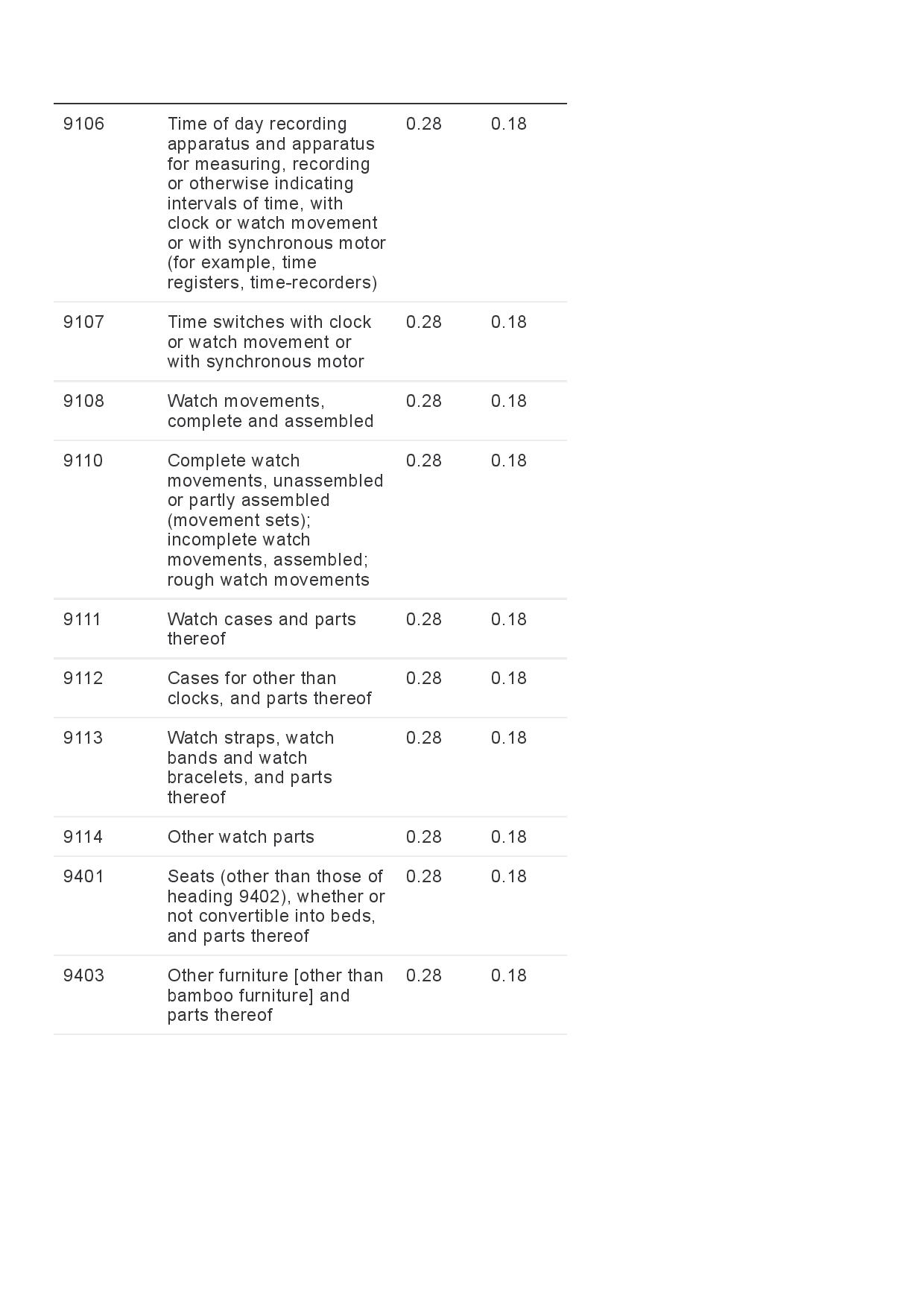

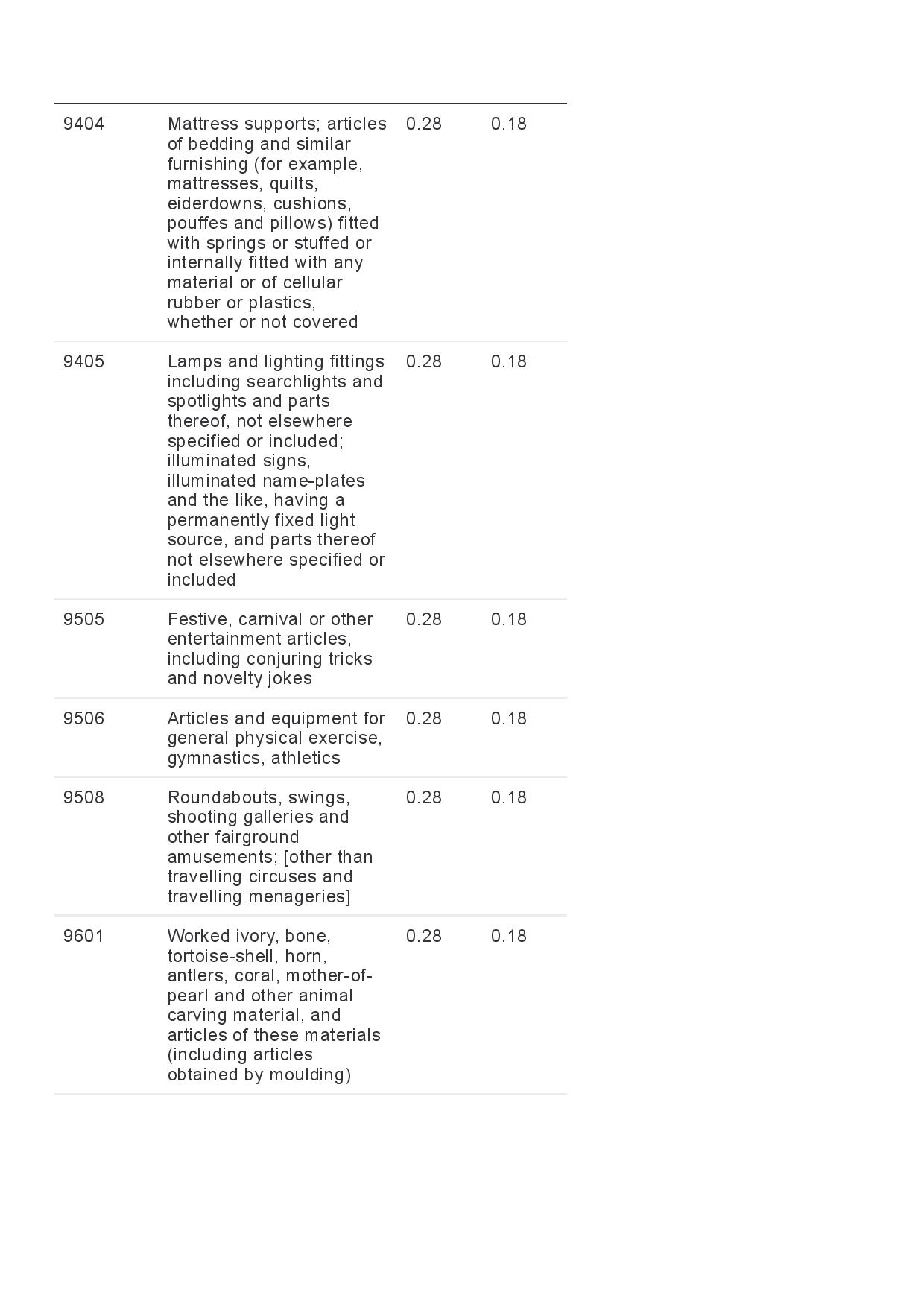

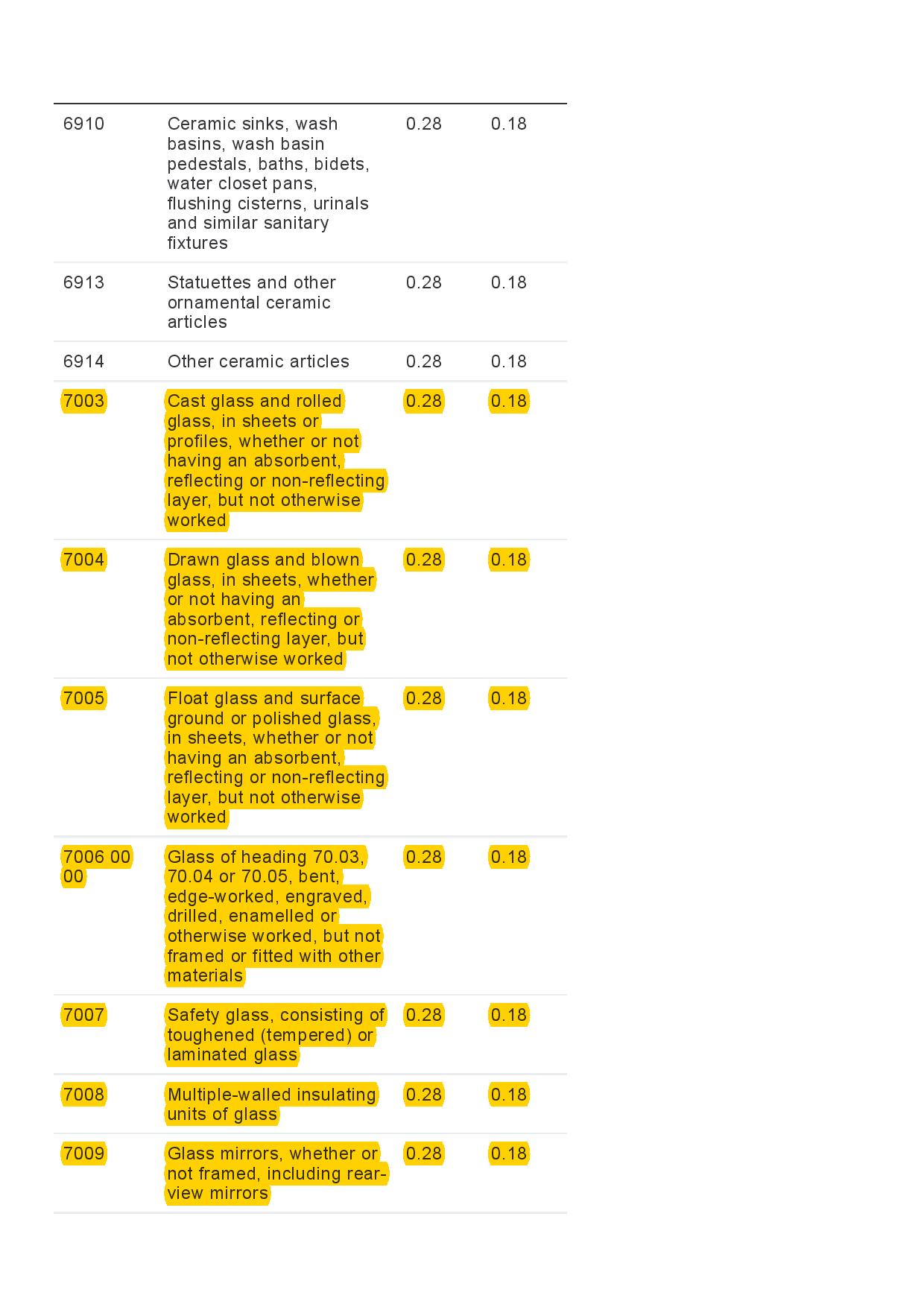

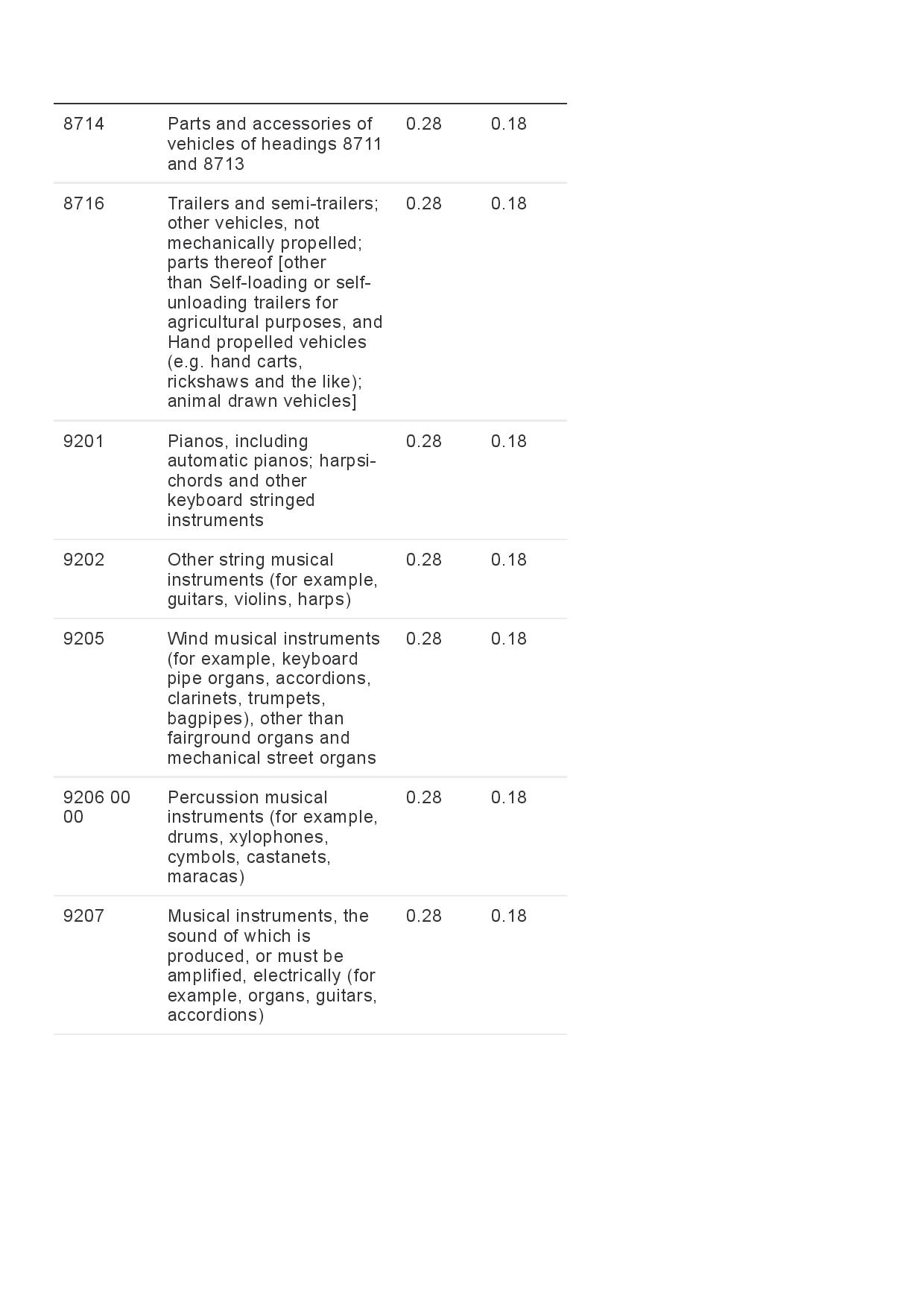

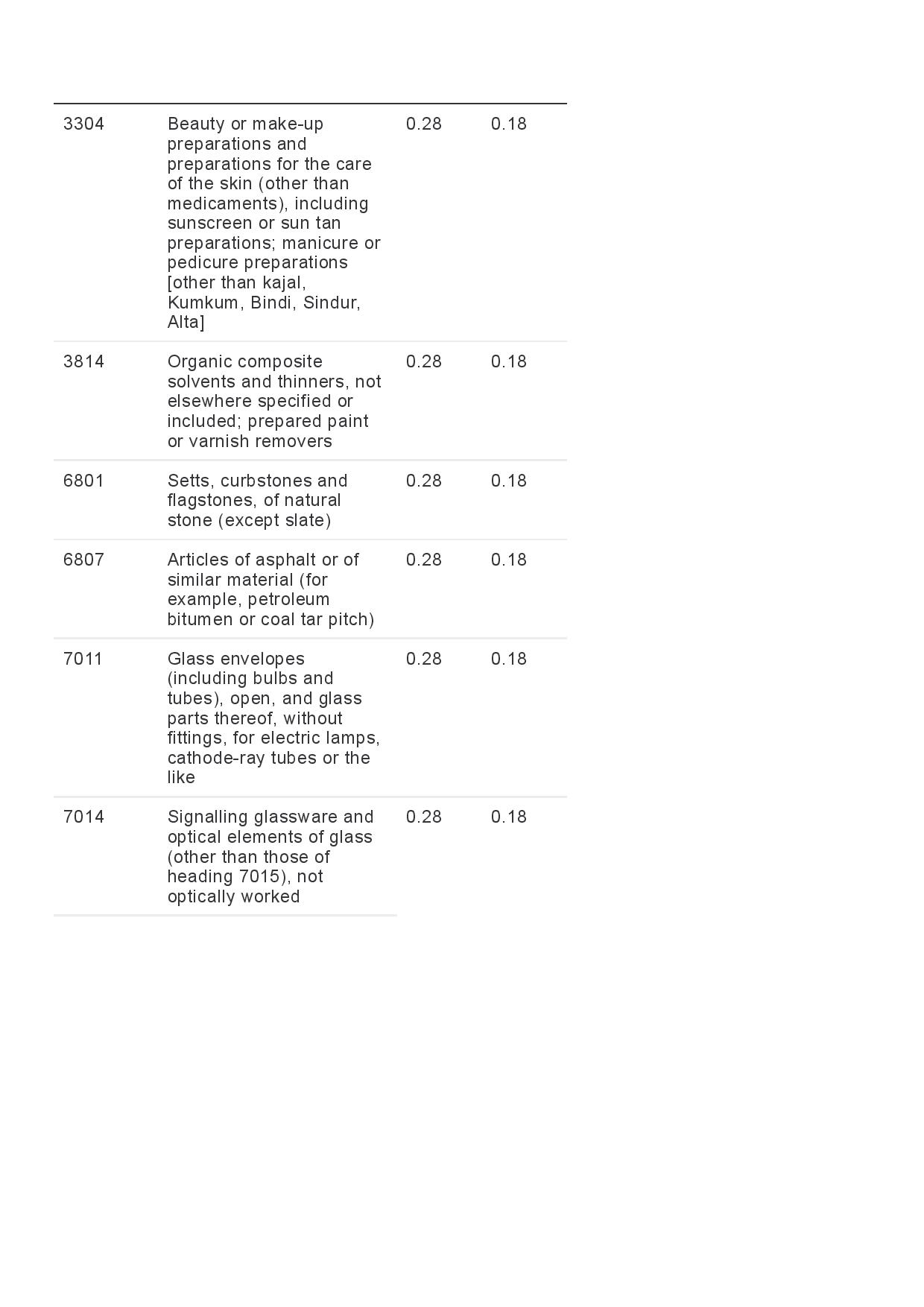

Here's the full list of GST rates

The Finance Minister said that all restaurants (AC & non-AC) will come under the 5 percent tax bracket, without Input Tax Credit (ITC). The decision had to be taken as the restaurants were not passing ITC benefits to customers. Customers were burdened as they were charging GST on previous rates.

“Detergents, marble, flooring, toiletries have been moved from 28% to 18%. Armoured fighting vehicles along with one more item have been shifted from 28% to 12%. Thirteen items have been moved from 18% to 12%. Six items have been shifted from 18% to 5%. Eight items from 12% to 8% and 6 items 5% to nil,” Jaitley said.

Comments

Post a Comment